Abstract: Maritime transport in Spain plays an essential role in the economy and international trade of the country. This research provides a detailed overview of the importance of maritime transport in Spain, highlighting its extensive coastline and strategic geographical location as key factors. Spain’s ports are vital for international trade, facilitating the import and export of goods and serving as crucial connecting points for passenger transport and logistics. In addition, fishing has a significant impact on the Spanish coastal economy, with an active fishing fleet supplying a wide variety of marine species. Seaports also play an important role in energy supply, with dedicated terminals for natural gas and oil. It also highlights aspects of maritime safety and environmental protection, which are regulated at both the national and international levels. In short, maritime transport in Spain is an essential component of its economy, boosting international trade, promoting economic development, ensuring the supply of food and energy, and contributing to tourism and fishing.

Key words: ports, TEUs, maritime, cargo

JEL: L91

Abstract: Námorná doprava v Španielsku zohráva zásadnú úlohu v hospodárstve a medzinárodnom obchode krajiny. Tento výskum poskytuje podrobný prehľad o význame námornej dopravy v Španielsku, pričom ako kľúčové faktory zdôrazňuje rozsiahle pobrežie a strategickú geografickú polohu. Španielske prístavy sú životne dôležité pre medzinárodný obchod, uľahčujú dovoz a vývoz tovaru a slúžia ako kľúčové spojovacie body pre osobnú dopravu a logistiku. Okrem toho má rybolov významný vplyv na španielske pobrežné hospodárstvo, keďže aktívna rybárska flotila zásobuje širokú škálu morských druhov. Námorné prístavy tiež zohrávajú dôležitú úlohu v zásobovaní energiou, s vyhradenými terminálmi pre zemný plyn a ropu. Zdôrazňuje tiež aspekty námornej bezpečnosti a ochrany životného prostredia, ktoré sú regulované na národnej aj medzinárodnej úrovni. Námorná doprava v Španielsku je základnou zložkou jeho hospodárstva, podporuje medzinárodný obchod, podporuje hospodársky rozvoj, zabezpečuje dodávky potravín a energie a prispieva k cestovnému ruchu a rybolovu.

Kľúčové slová: prístavy, TEU, námorná doprava, náklad

1 Introduction

Maritime transport plays a key role in Spain’s economy, taking advantage of its extensive coastline and strategic geographical location. With more than 7,900 kilometres of coastline stretching across the Mediterranean Sea and the Atlantic Ocean, Spain has a solid infrastructure and a rich tradition in the field of maritime transport. Maritime transport in Spain covers a wide range of activities and sectors. First, international trade is a vital part of this sector, with Spanish ports acting as entry and exit points for the import and export of goods. These ports are strategic hubs for transshipment and distribution, connecting Spain with the main international markets.

In addition to trade, maritime transport is also used for passenger transport, both domestically and internationally. Spain’s ports are popular destinations for tourist cruises, offering services and amenities to millions of passengers who visit the country each year. In addition, maritime passenger transport via ferries and ferries plays an important role in connectivity between Spain and other regions, such as the Balearic Islands and the Canary Islands.

Another relevant sector is fishing, Spain being one of the main fishing countries in Europe. The Spanish fishing fleet is dedicated to the capture and processing of a wide variety of marine species, contributing to the food supply and the fishing economy of the country. Maritime transport is also used for the supply of energy and natural resources. Spain has natural gas and oil terminals in its ports, which allows the import and distribution of these resources at the national level. In addition, some ports are important points of departure for the transport of petroleum products and other materials regionally and globally.

In terms of regulation, maritime transport in Spain is subject to national and international regulations and regulations. Port authorities and government agencies are responsible for ensuring maritime safety, environmental protection, and compliance with international standards in Spanish ports. In short, maritime transport plays an essential role in Spain’s economy and connectivity. Taking advantage of its extensive coastline and strategic location, the country has a strong port infrastructure that facilitates international trade, passenger transport, fishing, and the supply of resources. Maritime transport in Spain remains a vital sector that drives economic growth and strengthens commercial and cultural relations with other nations.

2 General information about water transport in Spain.

Maritime transport is a system of vital importance for the socio-economic development of the country because it imports most of a resource as strategic as energy, while exporting agricultural products or manufactured products. Moreover, the European Union, through the short sea shipping, has been encouraging for several years the use of this means of transport, because among other factors, it presents higher rates of economic and environmental efficiency, especially when compared to the road.

The Spanish State-owned Port System consists of 46 ports of general interest, managed by 28 Port Authorities, whose coordination and control of efficiency, corresponds to the Public Agency Ports of the State, organ dependent of the Ministry of Transport, Mobility and Urban Agenda that has attributed the execution of the port policy of the Government of Spain.

Source: Ministry of Transport Spain

Fig. 1. Map of the Spanish ports.

Ports of general interest have the following characteristics:

- International maritime commercial activities are carried out in them.

- They serve industries of strategic importance to the national economy.

- The annual volume and the characteristics of its maritime commercial activities reach sufficiently relevant levels, or meet the essential needs of the general economic activity of the State.

- Their special technical or geographical conditions are essential for the safety of maritime traffic.

It should be noted that port activity and maritime transport contribute 20% to the GDP of the transport sector.

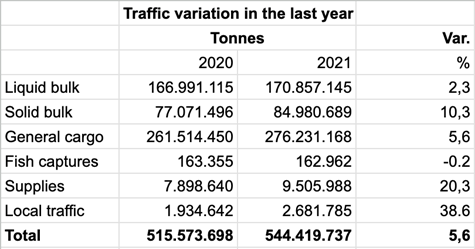

The Port System of State Entitlement moved in 2021 a total of 544.4 million tons of goods, with a variation of 5.6% over the year 2020, in which they moved 515.6 million. The evolution and composition of traffic has been as follows:

Tab. 1. Traffic variation in the last two years.

Source: authors

Source: authors

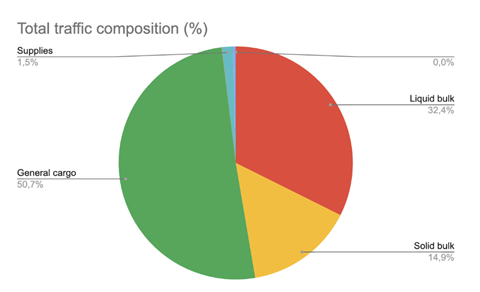

Graph 1. Traffic composition.

The 2021 data accounts for the recovery of most port traffics, standing at 20.1 million tonnes of the all-time high reached in 2019 at 564.5 million tonnes. In fact, in two Port Authorities (Castellón and Vilagarcia) their historical peaks have been reached.

This has been a year in which some of the restrictions imposed during the coronavirus pandemic have continued, most prominently affecting passenger traffic. On the other hand, global economic activity and maritime trade were marked for the same reason, as well as the collapse of some Asian and American ports.

By type of cargo, both liquid and solid bulk, as well as general cargo, mostly containerized cargo (72 %), increased this year.

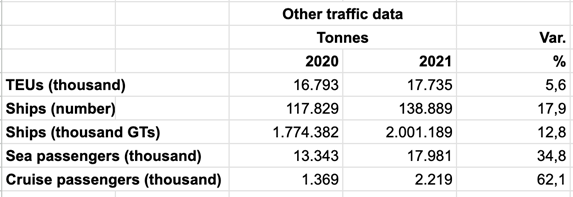

The following results were obtained for other important traffics:

Tab. 2. Other traffic data.

Source: authors

In 2021, the maritime transport of goods in our country continued to be fundamental to sustaining trade. Thanks to the fact that the world economy grew (6.1 %), although it did so to a lesser extent than expected, this in turn led to an increase in world maritime trade (by 3.3%) and therefore national trade. This is also influenced by the growth of the Spanish economy (5.1%).

Its advantages over other modes are the lower cost for long distance transport, the ease of moving large volumes, security against losses and less pollution, and in this sense, it is worth highlighting the good role played, despite the difficulties, by the Port Authorities in the logistics chains.

3 Transport of goods by water transport in Spain.

In this paragraph, you will be able to see the type of goods that has been transported by water transport since 1970.

Liquid bulk (170.9 million tonnes / +2.3 %).

In 2021, crude oil traffic increased by 3.1 % as well as its refined products fueloil (+4.6 %) and gasoil (+0.2 %), but petrol traffic decreased slightly (-2.9 %). This increase is due to higher demand.

Liquid bulk imports (mostly crude oil) have increased by 3.5%, and exports (mainly hydrocarbons and chemicals, including other bulk cargoes such as oils and fats and biofuels) have increased by 5.0 %. The price of a barrel of Brent crude oil recovered ($71/barrel on average compared to $42/barrel in 2020). Liquid bulk transit traffic, mostly petroleum products and chemicals, fell by 5.6 %. In the case of petroleum products, global storage and distribution strategies play a role. Natural gas traffic, on the other hand, increased by 7.0 % due to its increased use by ships. It is important to note that the supply of LNG to ships is guaranteed in all ports of general interest, at least using tankers. It is also worth mentioning in this section the traffic of biofuels (biodiesel, bioethanol) with an increase of 9.2 %.

Solid bulk (85.0 million tonnes / +10.3 %)

Solid bulk are the goods that have grown the most in percentage terms. This year, imports of bulk solids increased by 17.2 %. Exports increased by 3.4 %. And this despite decarbonization policies (including the closure of thermal power plants), which have led to a reduction in coal traffic (-14.4 %).

Coal and petroleum coke traffic, which until now was responsible for almost a fifth of the solid bulk tonnes moved through our ports, has been overtaken by other non-metallic minerals, which increased considerably (+30.3 %). Cereals and their flours, for their part, continue to be fundamental in this type of traffic and have grown by 1.9 %, even after the good harvest of 2020. Other mineral ores fell slightly (-0.9 %). Cement and clinker traffic in bulk form has increased (+19.1 %) due to higher demand despite losing some competitiveness in this sector due to the start-up of several factories in former importing countries.

General cargo (276.2 million tonnes / +5.6 %)

General cargo continues to be the main form of presentation by volume (51 % of the total). The traffics of chemical products, other foods, manufactured building materials, side surgical products, machinery, tools and spares, fruits and vegetables, and paper and pulp stand out. Compared to 2020, where domestic demand was very weak due to the circumstances, in 2021 imports of general cargo have increased remarkably (+15.9 %). On the other hand, thanks to the competitiveness of our economy and the positive values of the gross world product, exports of general cargo have increased by 10.8 %.

Regarding the traffic of general cargo in transit, which depends more on international economic activity, and is a highly volatile traffic due to the decisions made by economic agents based on their costs and the quality of services received, in 2021 it decreased by 3.3 %, representing almost a third of the total traffic. Cargo loaded or unloaded by ro-ro increased by 14.4 % thanks to the economic progress of North Africa, transporting fruit and vegetable products, textiles and livestock through the Strait of Gibraltar and products demanded by the islands.

Containers (17,712 thousand TEUs / +5.6 %).

Spanish ports handled 17.7 million TEUs in 2021, reaching an all-time high. This means that Spanish port terminals handle a daily volume of more than 49,000 TEUs per day. General cargo is mainly transported in containers (more than 72 % of all general cargo moving through our ports) as it facilitates its transportation without handling throughout the transport chain but requires a high degree of specialization of the terminals (with a tendency towards automation). In the same way that general cargo is divided, containers (measured in TEU) can be differentiated between those destined for import-export, which have increased by 12.5%, and containers in transit, which have remained at 2020 levels, 0.3 %, despite the general lack of containers to meet demand.

4 The most important ports and their comparison

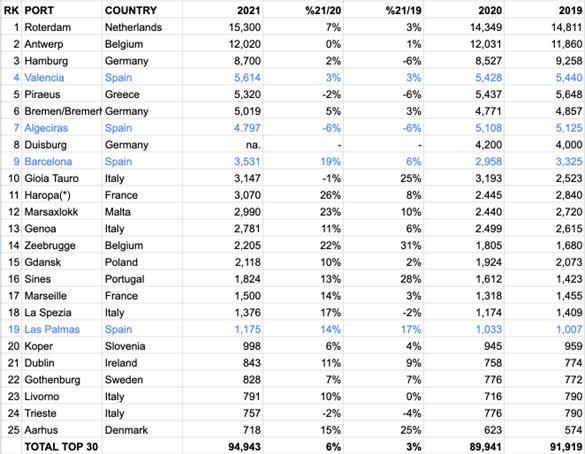

The Spanish port of Valencia overtook the Greek port of Piraeus to exceed 5 million TEUs again in 2021, an increase of 3% compared to 2020 and 3% compared to pre-pandemic levels.

Tab. 3. Ranking of European ports in thousands of TEUs.

Source: authors

Valencia, leading port in fourth place, Valencia is the leading Spanish port in the ranking, having overtaken the Greek port of Piraeus to consolidate its position as the leading European port in the Mediterranean. For the fourth year in a row, Valencia exceeded 5 million TEUs, with 3% growth both in 2020 and in the year before the pandemic. “The key to the port of Valencia is the combination of export/import traffic with transhipment.

Next is Algeciras, in seventh place. The two container terminals, managed by APM Terminals and TTI-Algeciras, handled almost 4.8 million TEUs, 6% less than in 2020.In 2021, imports grew by 15% with 197,198 TEUs, while exports grew by 6.7% with 221,489 TEUs.

Barcelona port, in ninth position in the ranking, moved 3.5 million TEUs, 19% more than the previous year. Its growth was the fifth fastest in the EU in 2021.

In the nineteenth position, Las Palmas port is, which closed last year with a throughput of nearly 1.2 million TEUs, which represents 14% growth, placing it, like Barcelona, among those that gained the most traffic in 2021. Las Palmas was the sixth fastest-growing European port, up 17% compared to pre-pandemic flows.

About Spanish inland ports, the port of Sevilla is the only inland seaport in Spain. It is a strategic enclave for the European Union and fully multimodal with maritime, rail and road connections. Sevilla total traffic remained the same as in 2020 (4.2 million tonnes). Liquid bulk increased and included chemical products, oils and fats, natural fertilizers and other foods. As for solid bulk, which decreased, the most important items were scrap iron, animal feed and fodder, fertilizers, cereals and their flours and potash. On the other hand, general cargo grew, mainly fruits and vegetables and other foods. TEUs also increased. The end of mobility restrictions had an impact on the reactivation of passenger traffic.

5 Conclusion

Spain’s coastline is the longest in the EU at almost 8,000 kilometres. Being a maritime trade window, the location of the Iberian Peninsula has a significant impact on foreign trade statistics. Indeed, the figures presented by the Spanish government once again reflect the prominent role of Spanish ports as engines of world trade. Last year, the country’s port system carried nearly 66% of the trade between Spain and the rest of the world. Specifically, 57% of exports and 73% of imports were by sea. Roughly the same percentage as in 2020 and 2019 before the pandemic hit. Nevertheless, the overall circulation is still affected by the health crisis. Spain’s imports and exports totalled 285 million tonnes last year, an increase of 8% compared to the first year of the pandemic, but 5% below 2019 levels.

In conclusion, Spain’s ports play a vital role in the economy and connectivity of the country. With an extensive coastline and a strategic location, Spain’s ports are key entry and exit points for goods, as well as passenger transport. These ports facilitate international trade, allowing the exchange of goods with other nations and connecting Spain to the main global markets.

Port infrastructure in Spain has developed significantly, with modern and efficient ports that meet international safety and management standards. Ports of general interest and ports of local interest complement each other, providing a wide range of services and activities related to maritime transport.

Overall, Spain’s ports are key drivers for economic growth, job creation and boosting trade. In addition, they contribute to the diversification of the economy, the promotion of tourism and the provision of food and energy resources. Spanish ports continue to be fundamental to Spain’s global competitive position and its active participation in trade and shipping.

6 References

- TRANSPORTE XXI. Puertos de España 2021. https://www.transportexxi.com/

- ATLAS NACIONAL DE ESPAÑA. Sistemas de transportes y comunicaciones > Transportes > Transporte marítimo. http://atlasnacional.ign.es/wane/Transporte_mar%C3%ADtimo

- PUERTOS DEL ESTADO. Anuario Estadístico OPPE 2021. https://www.puertos.es/es-es/estadisticas

- PUERTO DE SEVILLA. Estadísticas. https://www.puertodesevilla.com/

- EL CANAL MARÍTIMO Y LOGÍSTICO. Informe estadístico. https://www.diarioelcanal.com/maritimo/

- MINISTERIO DE TRANSPORTES, MOVILIDAD Y AGENDA URBANA. Memoria anual 2021. https://www.mitma.gob.es/marina-mercante/memoria-de-actividades-de-marina-mercante

Authors:

Ashley TALAVERA GONZÁLEZ 1, Andrej DÁVID 2, Andrea MATERNOVÁ3

Titles and place of work of the authors:

1Ashley TALAVERA GONZÁLEZ, Sección de náutica, máquinas e ingeniería naval. Avenida Ángel Guimerá Jorge, s/n. Escuela Politécnica Superior de Ingeniería. Apartado 456. Código postal 38200. San Cristóbal de La Laguna. S/C de Tenerife, Email: alu0101439280@ull.edu.es

2doc. Ing. Andrej DÁVID, PhD., Department of Water Transport, Univerzitná 8215/1, 010 26 Žilina, E-mail: andrej.david@uniza.sk

3Ing. Andrea MATERNOVÁ, PhD., Department of Water Transport, Univerzitná 8215/1, 010 26 Žilina, E-mail: andrea.maternova@uniza.sk